Transaction Advisory Services Can Be Fun For Everyone

Wiki Article

Some Known Details About Transaction Advisory Services

Table of ContentsFacts About Transaction Advisory Services RevealedA Biased View of Transaction Advisory ServicesTransaction Advisory Services - The FactsTop Guidelines Of Transaction Advisory ServicesGetting The Transaction Advisory Services To Work

This step makes sure business looks its ideal to prospective buyers. Getting business's worth right is critical for an effective sale. Advisors utilize different approaches, like discounted capital (DCF) evaluation, comparing to similar business, and current transactions, to determine the reasonable market worth. This aids establish a fair price and work out successfully with future buyers.Purchase experts step in to help by getting all the needed information organized, answering inquiries from customers, and setting up visits to the organization's place. Transaction experts use their know-how to assist service owners handle difficult negotiations, satisfy purchaser expectations, and structure deals that match the proprietor's goals.

Satisfying legal guidelines is vital in any type of organization sale. Transaction advising services deal with legal specialists to produce and review agreements, agreements, and various other lawful papers. This reduces threats and makes certain the sale follows the legislation. The role of transaction consultants prolongs past the sale. They help company owner in intending for their following steps, whether it's retirement, beginning a new endeavor, or handling their newfound riches.

Purchase consultants bring a wide range of experience and understanding, making certain that every element of the sale is taken care of expertly. With strategic preparation, valuation, and negotiation, TAS aids company owner achieve the greatest possible price. By making sure legal and regulative conformity and handling due diligence alongside other bargain employee, purchase advisors lessen possible threats and responsibilities.

See This Report about Transaction Advisory Services

By contrast, Huge 4 TS groups: Job on (e.g., when a possible purchaser is conducting due persistance, or when an offer is closing and the buyer requires to incorporate the company and re-value the seller's Equilibrium Sheet). Are with charges that are not connected to the offer closing efficiently. Gain costs per involvement someplace in the, which is less than what financial investment financial institutions make also on "small offers" (yet the collection likelihood is likewise much greater).

, yet they'll focus more on accounting and assessment and less on subjects like LBO modeling., and "accounting professional just" topics like test balances and just how to walk via occasions making use of debits and debts instead than economic declaration modifications.

The Buzz on Transaction Advisory Services

Experts in the TS/ FDD teams might also interview monitoring concerning every little thing over, and they'll write a detailed record with their searchings for at the end of the process., and the general shape looks like this: The entry-level function, where you do a lot of information and monetary evaluation (2 years for a promo from right here). The next level up; similar job, but you obtain the more fascinating bits (3 years for a promo).

Specifically, it's difficult to obtain advertised past the Manager level due to the fact that couple of people leave the work at that stage, and you require to begin revealing evidence of your ability to create earnings to advancement. Let's start with find out here now the hours and way of life because those are much easier to describe:. There are occasional late evenings and weekend job, yet nothing like the frantic nature of financial investment banking.

There are cost-of-living modifications, so anticipate reduced compensation if you're in a cheaper area outside major financial facilities. For all placements except Partner, the base pay makes up the bulk of the overall payment; the year-end bonus could be a max of 30% of your base income. Often, the very best means to boost your earnings is to change to a various firm and negotiate learn the facts here now for a higher income and perk

Not known Facts About Transaction Advisory Services

At this phase, you must just stay and make a run for a Partner-level role. If you want to leave, maybe move to a customer and do their evaluations and due diligence in-house.The primary issue is that because: You usually need to sign up with an additional Big 4 group, such as audit, and work there for a few years and afterwards move into TS, work there for a few years and afterwards move into IB. And there's still no guarantee of winning this IB role due to the fact that it relies on your region, customers, and the employing market at the time.

Longer-term, there is also some danger of and since assessing a business's historic economic information is not precisely brain surgery. Yes, human beings will certainly constantly need to be included, yet with more sophisticated technology, reduced headcounts could possibly sustain customer involvements. That stated, the Deal Providers team beats audit in regards to pay, job, and leave chances.

If you liked this write-up, you could be curious about reading.

All about Transaction Advisory Services

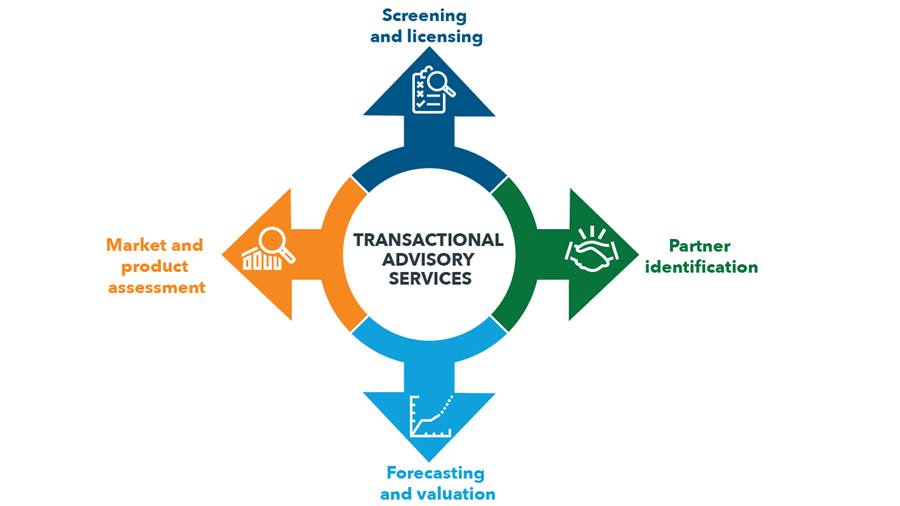

Create innovative monetary frameworks that help in determining the real market worth of a company. Provide advisory work in relationship to business evaluation to help in bargaining and rates structures. Discuss one of the most ideal type of the offer and the type of factor to consider to utilize (cash, stock, earn out, and others).

Establish activity prepare for threat and you can check here direct exposure that have been determined. Do integration preparation to determine the process, system, and business changes that may be called for after the deal. Make numerical estimates of integration prices and benefits to assess the economic rationale of combination. Establish standards for integrating divisions, technologies, and service processes.

Examine the potential client base, market verticals, and sales cycle. The operational due persistance supplies crucial understandings into the performance of the company to be obtained worrying risk evaluation and value development.

Report this wiki page